About

The Field Effect can accelerate change in your organisation, helping you and your people to deliver your vision and objectives. We combine our proven delivery methods with a unique business insight into clearing and collateral technology.

Business expertise

We are a boutique consultancy specialising in clearing and collateral management spanning cleared, non-cleared OTC Derivatives, Exchange Traded Derivatives and Securities Finance.

We provide advisory and implementation services to every participant in the industry value chain: buy-side and sell-side firms, clearing houses, custodians and CSDs. Our in-depth understanding of cleared and non-cleared OTC business processes, collateral segregation, transformation and optimisation, along with extensive experience of change management, allow us to add value to your organisation and a structured approach to your needs

Technology insight

We have worked with most of the collateral and clearing technology platforms, including Repo, Stock/Borrow lend, Exchange Traded OTC derivatives front and back office.

We have good working relationships with the clearing and collateral service providers such as prime brokers, custodians and ICSDs. We are also involved with the emerging collateral utility ecosystem.

Delivery methods and tools

Over the last 15 years the founders of The Field Effect have delivered more than 60 strategy and target operating model projects across investment banking, asset management and corporate banking. This experience underpins our proven methods, tooling and content.

As well as applying these methods to accelerate TFE client projects, we also license them to other consultancies or direct to financial service firms for use on their own projects.

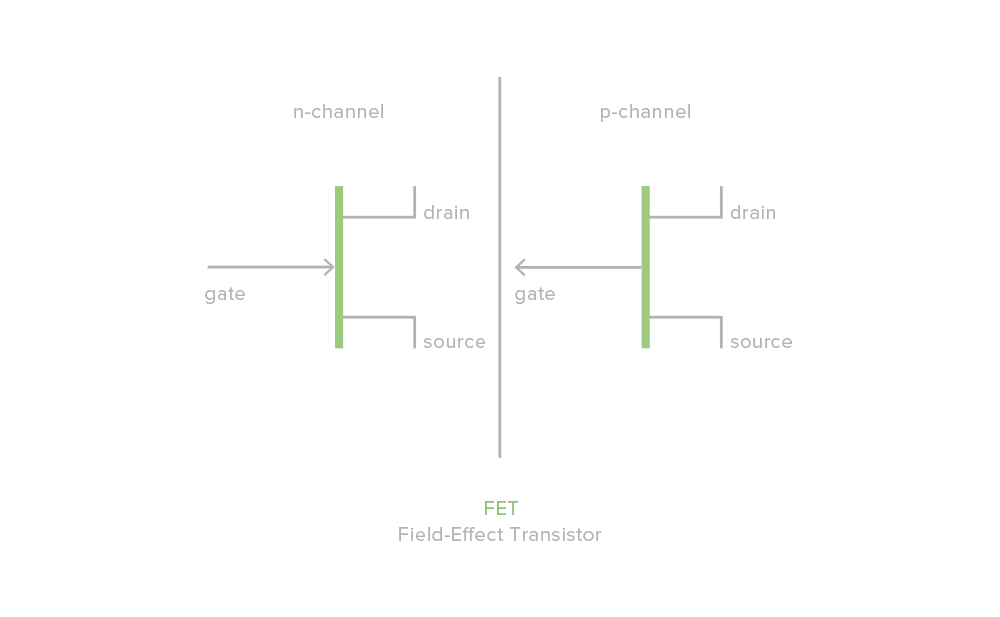

Where does the name come from?

The “field effect” is an electronics phenomenon in which a small external force switches on current in a resistive material - the basis of transistors and ultimately the electronics industry. The Field Effect Ltd is by analogy a small external force which switches on change in large organisations.

Extensive track record

TFE people have in-depth experience of clearing and collateral management challenges, gained from projects across Europe, Asia and America including:

- Clearing House: collateral and liquidity management business strategy

- Market infrastructure: operating model design for un-cleared OTC exposure netting

- Clearing House: target collateral operating model

- Buy-side: collateral target operating model and vendor system selections

- Sell-side: client clearing and collateral management services portal design

- Custodian: collateral management client services strategy and operating model

- Sell-side: ETD / OTC collateral optimisation requirements and vendor evaluation