Uncategorised

The Field Effect will be at ISLA 2018 in Lisbon

Venha e diga olá The Field Effect is very pleased to be sponsoring this years ISLA conference in Lisbon 19-21st June. We look forward to seeing you there. If you’d like to discuss changes to your securities lending business, from trading to collateral management and operations, along with SFTR implementation, please reach out to us. […]

Delta Capita and The Field Effect announce strategic alliance

London, 13 March 2018 – Delta Capita, the international business & technology consulting and managed services firm, has announced a strategic alliance with The Field Effect, a London-based consultancy specialising in securities financing, clearing and collateral management. The alliance will deliver a strong combined capability in prime brokerage, securities finance and collateral management designed to […]

SFTR Scenarios & Key Considerations

Following extensive review of the SBL / Repo Landscape – including the actors involved, information flows and functional requirements, we have identified four SFTR reporting scenarios that firms will need to consider: Some firms will be looking to fully delegate the reporting function, including data enrichment before sending data to a Trade Repository. Others will […]

Merging of stock lending & OTC derivatives collateral management

Derivatives and Securities Finance businesses are clearly aligning. Both business areas are looking to mitigate their capital consumption and maximise the use of collateral. Driven by increased Initial Margin demands in the OTC space, some firms are aligning their collateral management functions in order to maximise optimisation and use of collateral, whilst leveraging Tri-Party processing efficiency. This […]

NSFR Impact Analysis – Mark Barnard

Implementation of the first tranche of funding ratios (LCR) was relatively painless. This potentially lulls us into a false sense of security when considering the next tranche – NSFR. Whilst LCR changed the funding profile of the industry, NSFR’s movement of the tenor of liquidity generation to greater than 6 or 12 months dependent upon […]

New Article: Trends & Challenges in Collateral Management

Simcorp asked David Field & Nick Stafford to write an article on the current trends and challenges in collateral management. Industry players tend to react too late to regulatory change, necessitating tactical and inefficient projects. For quite some time the focus for sell-side firms has been reducing costs, we see serious savings if steps are […]

SFTR dominates the ISLA Conference

There was lots of talk of SFTR impacts at the ISLA conference last week. It’s clear that the enormity of changes required to meet reporting requirements at both an industry and individual firm level are starting to concern market participants. Firms are at varying stages on their preparation timeline and there is still much to […]

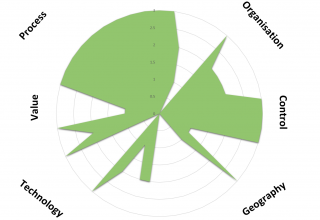

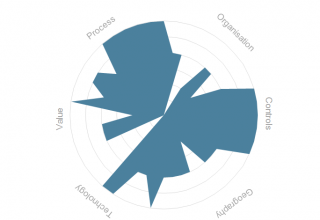

SFTR Impact Analysis

Whilst the drive is towards SFTR compliance, the business will need to know the impact on their trading activity and operating model. Additionally, what are the costs of implementing SFTR and on-going reporting? Like many regulations, its envisioned that there will be further enhancements in the future, once the dust has settled, what will be […]

The Field Effect is heading to the ISLA Conference 2017

David Field (Managing Director), Mark Barnard (Sec Finance Practice Lead), Simon Davies (Senior Consultant) & Neelam Rathod (Senior Consultant) will be attending this year’s ISLA conference. They are looking forward to meeting you all and discussing major challenges facing the industry including SFTR. To read more about the event, click here

Derivatives Margin Requirements & Legal Documentation

Banks and Investment Managers are seeing an increase in the complexity and scope of the legal documentation challenge, with mass repapering requirements around Derivative collateral management being just the tip of the iceberg. Its time to look at how efficiently you extract and use data from your legal documents, not just to meet regulatory requirements, […]