Author Archives: Julian Eyre

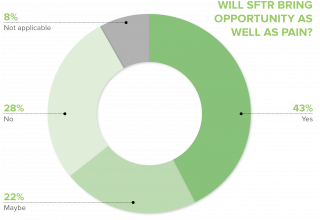

Will SFTR will bring opportunity as well as pain?

An audience of 700+ securities finance professionals at Clearstream’s recent Global Funding & Finance conference think so. David Field chaired a panel exploring the impact of regulation (not just SFTR!) on the securities finance industry. The Field Effect has identified at least four areas where firms can generate opportunity from regulation. But it won’t happen […]

How will your firm be incentivised?

More so than ever, Investment Banks are looking to unlock value on all the assets that reside on their balance sheet but, are constrained by traders not allowing certain assets to be used as current transfer pricing mechanisms are not compensating them adequately. Historically, transfer pricing models were created to help with internal asset utilisation, […]

SFTR: Navigating the challenge

Following our breakfast event, sponsored by EquiLend and Trax, where we talked to firms about the impacts of the SFTR reporting requirements, we are pleased to announce the publication of our most recent whitepaper on SFTR and its impacts. Our analysis shows that firms are missing up to 40% of the data that they are […]

The EC expects Securities Financing transaction reporting to start in 2019

The European Commission (EC) published their review of the securities finance market on 19th October 2017. This includes a report of the progress in international efforts to mitigate the risks associated with securities finance transactions (SFTs) and an assessment of the European SFT market. This report is required under SFTR and is used to report […]

SFTR Breakfast Briefing with EquiLend, Trax, DTCC and a Buyside firm

The Field Effect, in association with EquiLend & Trax, would like to invite you to hear from securities finance and regulatory reporting SMEs on SFTR. Please join us for breakfast, networking and updates from leading industry experts. The breakfast briefing event will be held on Wednesday 6th December 2017, at Pewterers Hall, Oat Lane, London EC2V […]

What’s on your bucket list?

Very few consumers will buy a product without knowing the cost of the item, and even less would agree to this concept for every purchase they make. How can you ensure you are paying the market rate? Separately, if you intend to sell the item on to a third party, how can you price the […]

Cleared and OTC Derivatives Transforming the Collateral Landscape

ISDA recently re-launched their annual collateral survey* to assess the collateral usage and make up within the derivatives market. This captures the 20 Phase 1 firms posting regulatory IM/VM on uncleared derivatives for the first time. ISDA reports that collateral totalling $47 billion was posted and $47billion received for regulatory IM, compared to $16billion and […]

Doing more with less – STP/Zero-touch

Many Securities Finance businesses are under pressure to increase their straight through processing (STP) capabilities thereby reducing the need for manual intervention. With growing settlement volumes, it is not economically viable to increase headcount in support functions in a linear manner. As such, the desire to achieve a zero-touch post trade settlement environment continues to […]

Usain Bolt, Mo Farah and the race to reducing settlement cycles?

Usain Bolt’s reaction time from the gun is critical. He requires the ability to explode from the blocks, optimise momentum into the drive phase and then maintain maximum speed through to the finishing line. The race is too short for errors to be corrected and still win. Indeed, a huge proportion of Usain’s training is […]

We’ve moved…

The Field Effect has moved from Canary Wharf to the City. Our new offices are over in Clements Lane to give us more space and a central location. Our new mailing address is: The Field Effect 27 Clements Lane London EC4N 7AE Call us on: 020 3906 7369