Service

Common Domain Model Frequently Asked Questions

Following the recent initiative from ISDA to develop and codify a Common Domain Model it seems that there is an opportunity to clarify and explain what a CDM may be and its possible uses. The FAQ document attached CDM FAQ_1 Nov Final is a preliminary look at a CDM and its potential application to the Securities Finance […]

The EC expects Securities Financing transaction reporting to start in 2019

The European Commission (EC) published their review of the securities finance market on 19th October 2017. This includes a report of the progress in international efforts to mitigate the risks associated with securities finance transactions (SFTs) and an assessment of the European SFT market. This report is required under SFTR and is used to report […]

Initial Margin & Variation Margin for OTC Derivatives

Outline In March 2017 Variation Margin (VM) requirements for non-cleared derivatives went live. Counterparts entering into any non-cleared derivative trades with a notional value of $500k+ must agree and exchange VM bi-laterally daily. Initial Margin requirements are a little more complicated with a phased approach to implementation based on the outstanding notional amount of overall […]

Liquidity Efficiency

Front to back businesses have procedural weaknesses prohibiting the ability to maximise the value contained within the asset side of the balance sheet. Financing desks need to structure their activities to complement the needs of their treasury departments. Industry Challenges Trapped liquidity not realised Assets not maximised on balance sheet Lack of collaboration with the […]

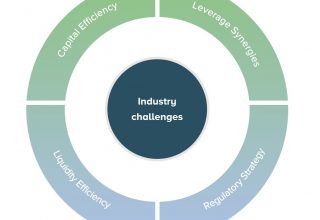

Securities Finance

The Field Effect offers transformation services, to help firms optimise funding and reduce run-the-bank costs by combining equities, fixed income and treasury cash management infrastructure into a streamlined front-to-back office capability The Field Effect has identified four key areas to strengthen the value your Securities Finance business provides across the organisation. Download our Securities Finance […]

Custodian collateral services strategy

Custodians must recognise the impacts of clearing and collateral regulations on their customers, and anticipate their likely requirements for collateral services. In particular custodians must provide facilities for customers to allocate assets for margining cleared OTC, which must be held at a designated Securities Settlement System (SSS). Each firm needs a customer collateral strategy that […]

Clearing and collateral architecture

The applications architectures implemented in most firms have evolved historically within divisions and silos from local business drivers. The new clearing and collateral regulations are forcing large scale change on legacy architectures, often highlighting massive duplication. Single business functions implemented in many different systems require multiple change projects to implement one change, at a cost […]

Collateral data model

With today’s cost pressures combined with modest revenue opportunities, all firms must design target collateral infrastructure to be highly cost-efficient enabled by straight through processing. Poor data quality has long been known to be a major barrier to STP. As cleared volumes are set to rise dramatically, firms without a high quality data strategy face […]

Clearing & Collateral Strategy

Clearing & Collateral is our domain. We operate across Buy-side, Sell-side, Custodians and CCPs. We add value by combining decades of experience with a unique methodology.

Collateral and clearing implementation

As budgets firm up, strategic roadmaps must be developed into detailed plans that can be executed. The Field Effect can help with every aspect of delivery: Programme management Clearing and collateral subject matter experts Project / workstream management Programme Management office (PMO) Business analysis Architecture design Testing The Field Effect can help you plan, mobilise […]