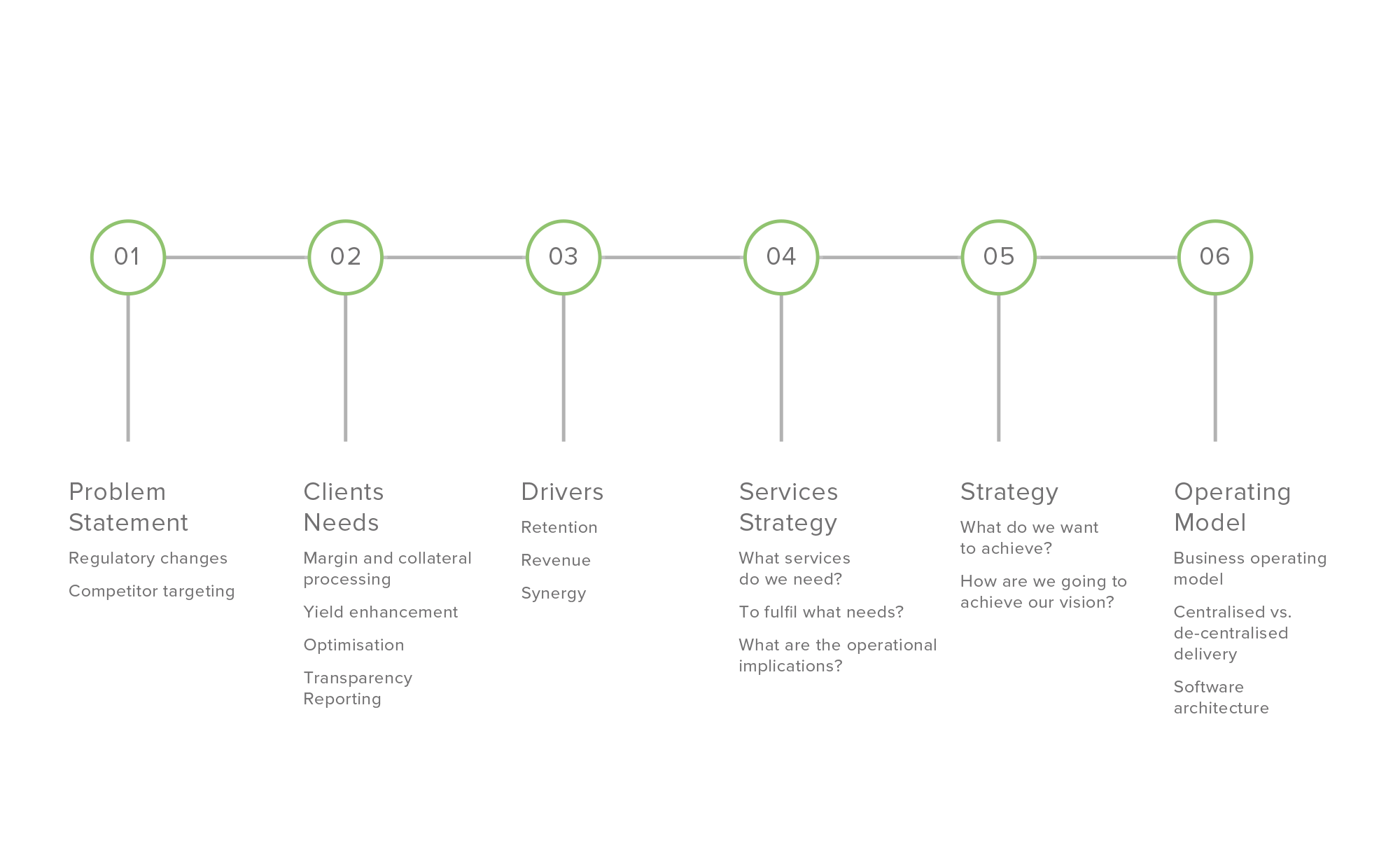

Custodian collateral services strategy

Custodians must recognise the impacts of clearing and collateral regulations on their customers, and anticipate their likely requirements for collateral services.

In particular custodians must provide facilities for customers to allocate assets for margining cleared OTC, which must be held at a designated Securities Settlement System (SSS). Each firm needs a customer collateral strategy that addresses critical issues such as:

- Which customer segments will be impacted by what regulations, when?

- What tri-party or other mechanisms must be established to help customers mobilise assets across sub-custody networks?

- What collateral services does each customer segment need, and can the custodian integrate optimisation or transformation services from their markets division (if they have one)?

- How will the custodian minimise disintermediation risk?

- Customer visibility of assets pledged against which margin calls, held in which venues and segregated accounts.

- Legal documentation.

- Market infrastructure connectivity and messaging.

- Infrastructure provisioning: build vs buy; vendor vs utility.

TFE can help you develop your strategy quickly and efficiently based on our deep expertise in clearing and collateral, underpinned by our structured methods and tools.

If you think TFE could help your business please get in touch