Collateral vendor / utility selection

Firms of all types may need to consider investment in third party technology or services.

Buy-side firms typically have little collateral infrastructure; many sell-side firms recognise their existing collateral technology is not fit for purpose; custodians may not have suitable collateral management technology for customer needs. Fortunately many new collateral management software vendors, service providers and industry utilities are emerging. Vendor selections must consider:

- Key functional requirements described as user stories / use cases, with sample data.

- Non-functional requirements such as performance, throughput, availability, and architectural agility.

- Commercial considerations: not just price but terms of business, ease of contracting, track record, and skills availability.

- Can services be outsourced (to broker, custodian or business process outsourcer)?

- Can collateral industry utilities provide key components such as margin calculation, portfolio reconciliation, risk sensitivity recs, dispute management, CSA management, margin transit and tracking?

- Who should be involved in the decision and how should objectivity be maintained?

- How should solutions be scored and weighted?

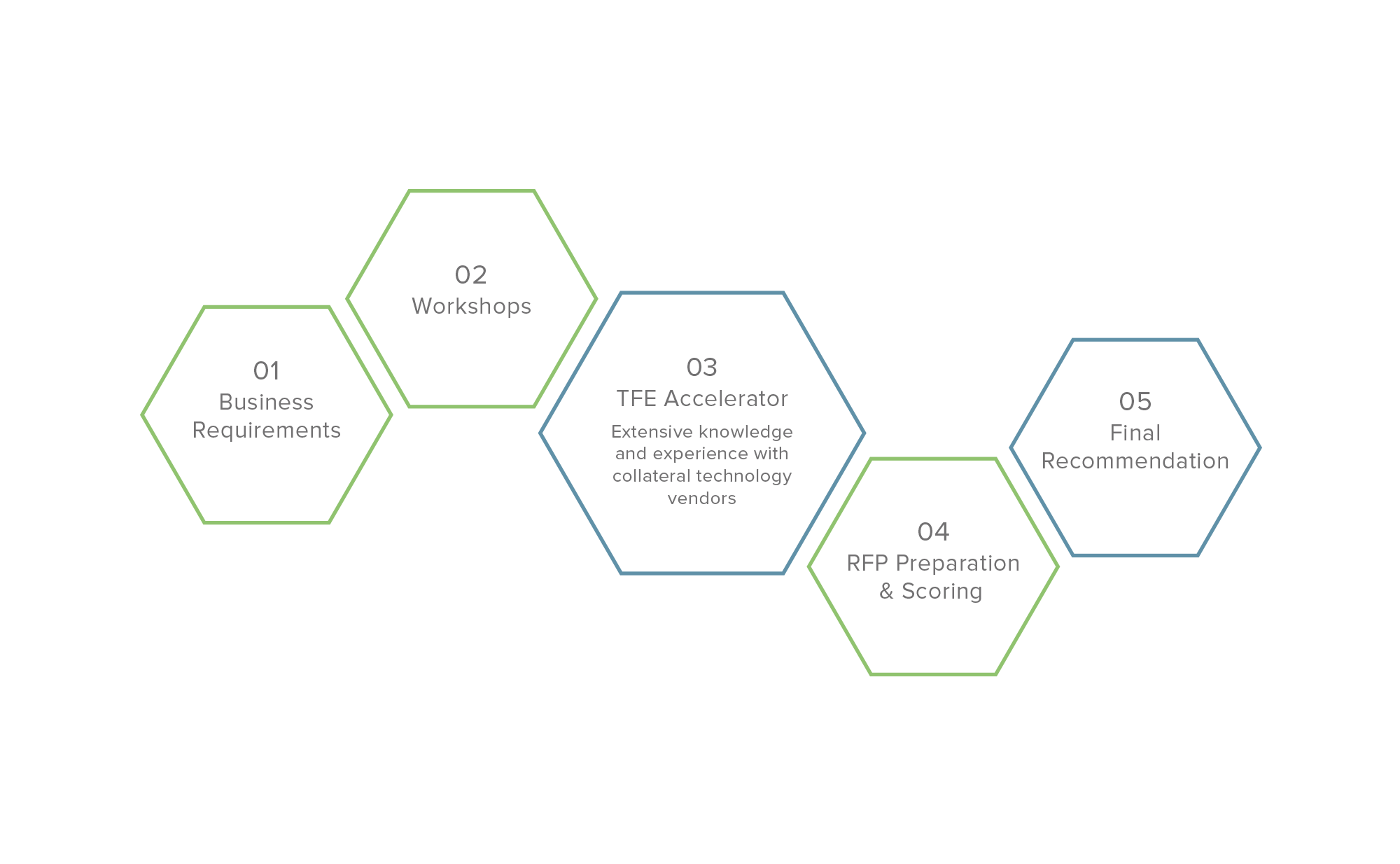

TFE can help you develop your strategy quickly and efficiently based on our deep expertise in clearing and collateral, underpinned by our structured methods and tools.

If you think TFE could help your business please get in touch